June 12 , 2013

COMPTROLLER MARAGOS: DESPITE COSTS OF SUPERSTORM SANDY,

NASSAU COUNTY ENDS FISCAL YEAR 2012 WITH $41.6M SURPLUS

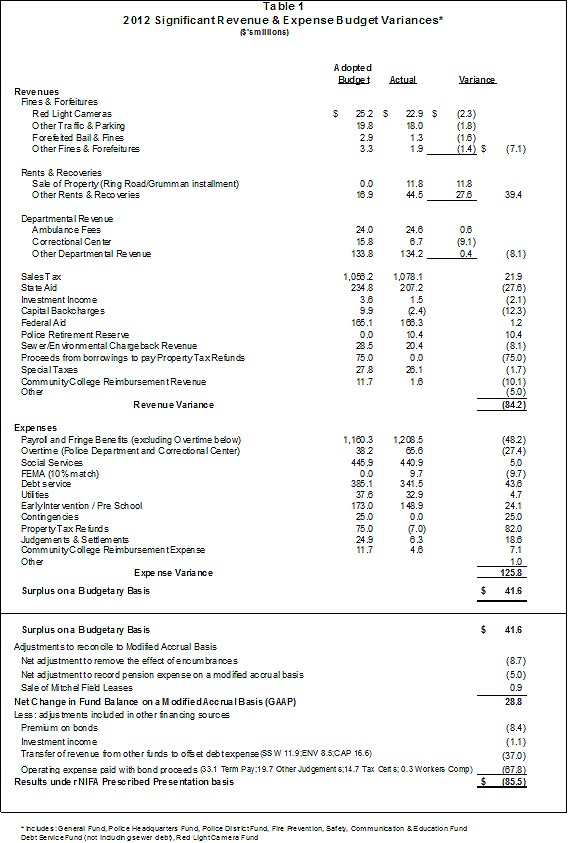

Mineola, NY- Nassau County Comptroller George Maragos released the County’s 2012 year-end unaudited fiscal results today and reported that the County is expected to end with a budgetary surplus of $41.6 million. These results include $9.7 million in unanticipated costs representing the County’s 10% portion of Superstorm Sandy related expenditures. The 90% remaining balance of eligible County Superstorm Sandy expenditures is expected to be reimbursed by FEMA as a result of the recent Presidential Declaration. The detailed variance analysis on a budgetary basis is shown in Table 1.

“The Mangano Administration held the line on property taxes while delivering a 2012 budgetary and GAAP surplus by controlling expenses, refinancing debt, imposing a nonessential hiring and wage freeze, and litigating property tax grievances,” Comptroller Maragos said. “The improving economy also helped by increasing sales tax revenues.”

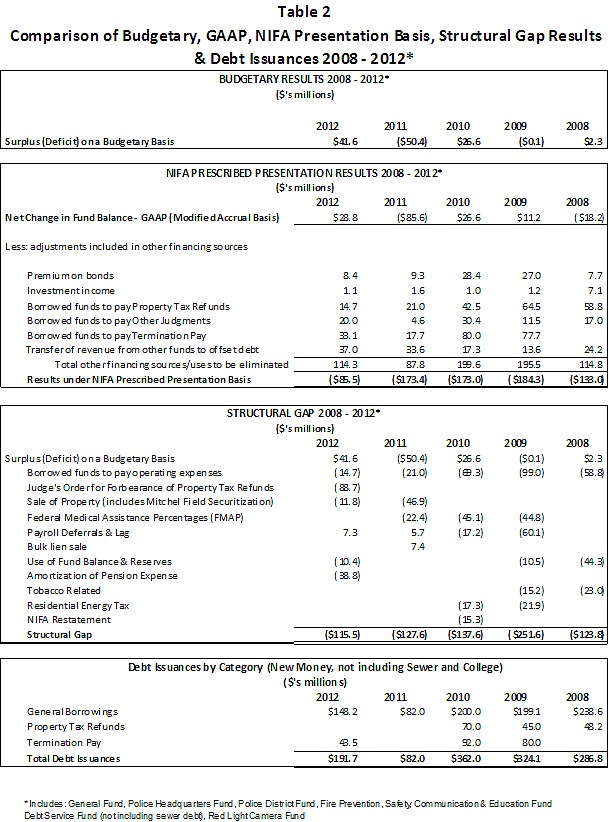

Under Generally Accepted Accounting Principles (“GAAP”) as required for governmental financial reporting, the County’s unaudited results for the fiscal year are expected to be a surplus of $28.8 million. For the second consecutive year since the Nassau Finance Interim Authority (NIFA) was created in 2001, NIFA also requires the County to report its financial results on a basis that excludes other financing sources. Under the NIFA prescribed presentation method, the County is expected to end 2012 with a negative $85.5 million result, which is a 54% improvement compared to the negative $184.3 million recorded in 2009, the final year of the previous Administration, and down from the negative $173.4 million in 2011.

The Structural Gap, which has been used historically to measure the financial health of the County, has also continued to improve for the third consecutive year. The Structural Gap has progressively improved to $115.5 million from $251.6 million in 2009, a 54% improvement. The Structural Gap is the difference between recurring revenues and expenses, and excludes non-recurring items that are customarily used to arrive at the budgetary balance, such as borrowings, and extraordinary items.

The amount of new money debt issuances by the County during 2012 (excluding debt for Sewer and Storm Water and for Nassau Community College purposes) was held at $191.7 million, approximately 40% less than in 2009. This borrowing was used primarily for termination pay and capital projects.

Table 2 shows the comparative five-year financial presentation of County finances using the different presentation methodologies, Budgetary, Governmental GAAP, NIFA Presentation and Structural Gap. It is worth highlighting that in all presentation forms, the County’s financial fundamentals have improved under the Mangano Administration compared to 2009.

Table 1 summarizes the major budget variances. Although revenues were lower than budgeted by $84.2 million or about 3.0%, the expenses were also lower by $125.8 million or 4.5% resulting in the $41.6 million budgetary surplus. The budgeted revenue fell short primarily due to $75 million in unapproved bonding to pay property tax refunds, $27.6 million in lower State Aid and a $7.1 million shortfall in Fine and Forfeiture revenues, but offset by $39.4 million higher income from Rents and Recoveries, $21.9 million in higher sales tax revenues and $10.4 million from the Employee Benefit Fund Reserve, which was used to fund termination pay.

Expenses were also lower by $125.8 million due to $43.6 million lower debt costs due to fewer borrowings and lower borrowing rates, the availability of $25.0 million in contingencies, $24.1 million in lower Early Intervention and Pre-School Costs, and $82.0 million attributed to budgeted tax certiorari refund costs that were not spent as the borrowing for those costs was not obtained. The lower expenses were offset by $48.2 million in higher Payroll costs primarily due to unbudgeted termination pay and the timing of staff reductions, and $27.4 million in higher Police and Corrections overtime costs.

Comptroller George Maragos concluded that, “continuing the broad fundamental fiscal improvements will present major challenges to the County going forward. State mandates will continue to present increasing burdens to the County and all other counties Statewide unless Albany takes action to control the ever-growing costs associated with Medicaid, pensions and unfunded mandates. The improving economy will help but it is not expected to generate sufficient additional sales tax revenues to offset these rising costs. Additionally, the wage freeze court challenge and the growing long-term certiorari liability are additional risks that may have an impact to the County’s operations going forward and must be addressed in the 2014 Multi-Year Plan.”

The fund reserve, although replenished by the $41.6 million budgetary surplus to approximately $82 million, is about 3% of prior year expenditures and below the County’s established policy of 4%, which still leaves the County vulnerable to unanticipated expenditures and adverse court judgments.

The liability for property tax refunds requires immediate attention. This liability has increased to approximately $335 million at year-end 2012 because of lower payouts. If the County is unable to bond for these certiorari liabilities, the effect will have a significant negative impact to the County. On a positive note, however, the estimated new property tax liabilities added in 2012 were $58 million, the lowest since 2008, and highlights the improvements in the Assessment System introduced with the Four Year Cycling Assessment Formula.

Connect with

Nassau County Comptroller Maragos Online:

http://www.nassaucountyny.gov/agencies/Comptroller/index.html