August 7, 2013

Maragos: County Projected to End 2013 with $5.6M Budgetary Surplus Due to Improving Economy

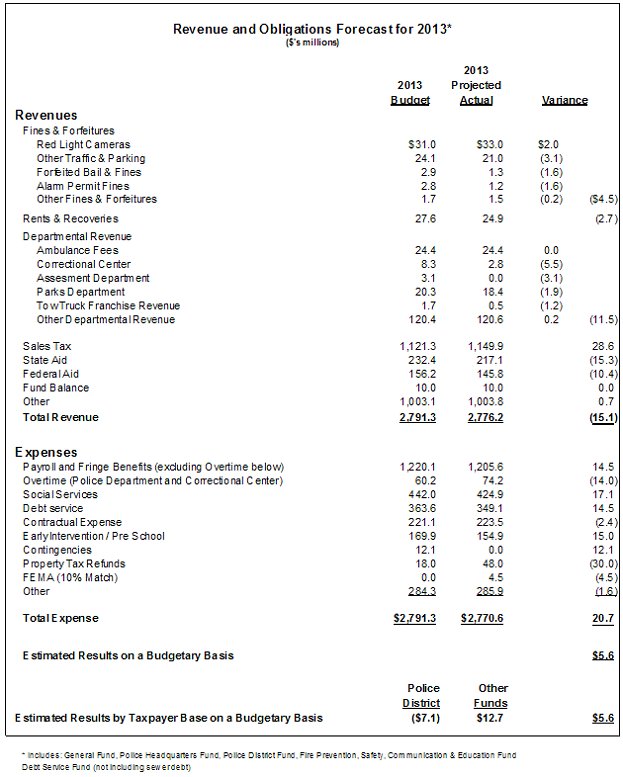

Mineola, NY- Nassau County Comptroller George Maragos released the 2013 mid-year financial projections which indicate that the County will end with a $5.6 million budgetary surplus for the primary operating fund. The surplus is due to increased revenues from the improving County economy as is reflected in increased sales tax revenues (up 10.4% year to date and projected to end up 7.2%), reduced unemployment at 6% and a decline in Social Services expenses and expenses related to the Early Intervention/Pre-School program. These positive factors out-weigh the $25.7 million in lower State and Federal Aid due to lower cost reimbursements.

"The County economy has been able to rapidly recover from Superstorm Sandy and continues to grow faster than neighboring counties and the national economy,” said Comptroller George Maragos. “This economic growth has increased sales tax revenues at a remarkable 10.4% year to date while the administration has kept a tight rein on costs. The combination of higher revenues and lower budgeted costs will help the County achieve the third budgetary surplus in the last four years. The County will be financially stronger with the highest fund balance since 2010 and the lowest structural deficit since 2005.”

Under the presentation basis prescribed by the Nassau County Interim Finance Authority (“NIFA”), which excludes other financing sources and uses, the County would be ending the year with a negative $119.6 million, an increase of 39.9% over 2012 but a 35.1% improvement from 2009 under the Suozzi Administration. The increase over 2012 is primarily due to the higher bonding for property tax refunds and the payment of the MTA judgment.

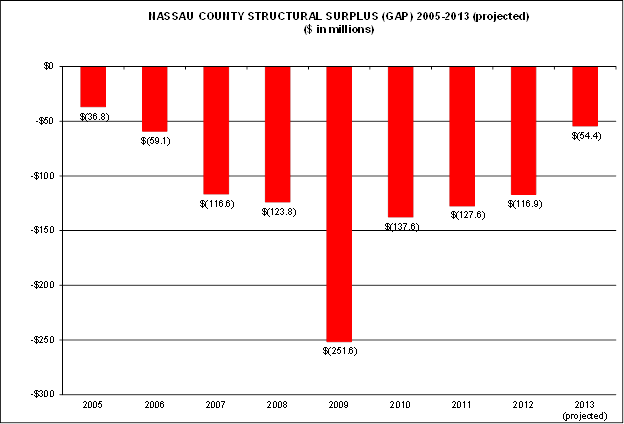

The County’s other major fiscal fundamental, the structural gap (the difference between recurring operating revenues and expenses), will continue its year over year improvement since 2009 as shown in the chart below. The structural gap is projected at $54.4 million, down from $116.9 million in 2012 – a 53.5% improvement and down from $251.6 million in 2009- a 78.4% improvement, under the previous Administration, and further underscores the improving County financial fundamentals.

The liability for property tax refunds appears to have been addressed and is expected to decline. The payment of $88 million in property tax refunds projected in 2013 will reduce the long-term property tax refund liability from its current level of $297.2 million at year-end 2012 to about $289.2 million, after estimated additions of $80 million during 2013.

New money debt issuances for 2013, excluding debt for sewer projects, are projected to be approximately $407 million, assuming the $65 million in proposed bonding for property tax refunds and police termination pay will be foregone and paid by recurring revenues. Of the borrowing, $104 million is for Superstorm Sandy-related recovery and approximately $200 million is for capital projects. However, $40 million will still be bonded for property tax refunds and are included in the budgetary results.

At year-end 2012, the total of County general obligation (excluding debt for Sewer District projects) and NIFA bonds debt was $2.7 billion. The debt service for principal, interest and financing costs relating to this debt was $366.3 million. The 2013 anticipated borrowing (excluding $65 million for property tax refunds and termination pay) will increase the County’s general obligation and NIFA bonds (excluding Sewer District borrowings) outstanding from $2.7 billion to approximately $3.0 billion.

The wage freeze court challenge

continues as a risk that may have an impact to the

County’s operations

going forward and should be addressed in the 2014 Multi-Year

Plan or resolved. However, this risk has been diminished

because of the County’s growing fund balance and

rising sales tax revenues from the improving economy.

EXHIBIT 1

![]() 2013

Mid-Year Report on the County's Financial Condition

2013

Mid-Year Report on the County's Financial Condition

Connect with

Nassau County Comptroller Maragos Online:

http://www.nassaucountyny.gov/agencies/Comptroller/index.html