Mangano & Maragos Announce: Nassau County Ends Fiscal Year 2010 With A $17.2 Million Surplus

The Structural Deficit Was Reduced by $120 million,

a 48% Improvement

Nassau County Executive Edward P. Mangano and Comptroller George Maragos released the County’s 2010 year-end unaudited fiscal results today and reported a surplus of $17.2 million. Comptroller Maragos also reported that fiscal year 2010 saw a 48% reduction in the structural deficit, from $251.6 million to $131.6 million.

County Executive Mangano stated: “On January 1, 2010, I inherited a budget deficit of $133.2 million and I immediately responded by signing a law repealing the home energy tax. A tax on everything and anything used to heat or cool your home; oil gas, electricity and even firewood. My action fulfilled my pledge and reinforced my commitment to save taxpayer’s real dollars. The critics claimed my action of giving money back to residents was wrong. I disagree. I have been able to put money back into our taxpayers pockets, reduce the size of government to the lowest levels since the 1950’s, all while turning a tremendous deficit into a $17.3 million surplus. We have put this County on a diet and its working.”

“This is a remarkable achievement by the Mangano Administration which inherited a budgetary deficit of $133.2 million based on overly optimistic revenue projections and costly labor agreements and deferred raises. The Mangano Administration was able to deliver the surplus by slashing departmental costs, controlling expenses and by imposing a hiring freeze,” Comptroller Maragos said.

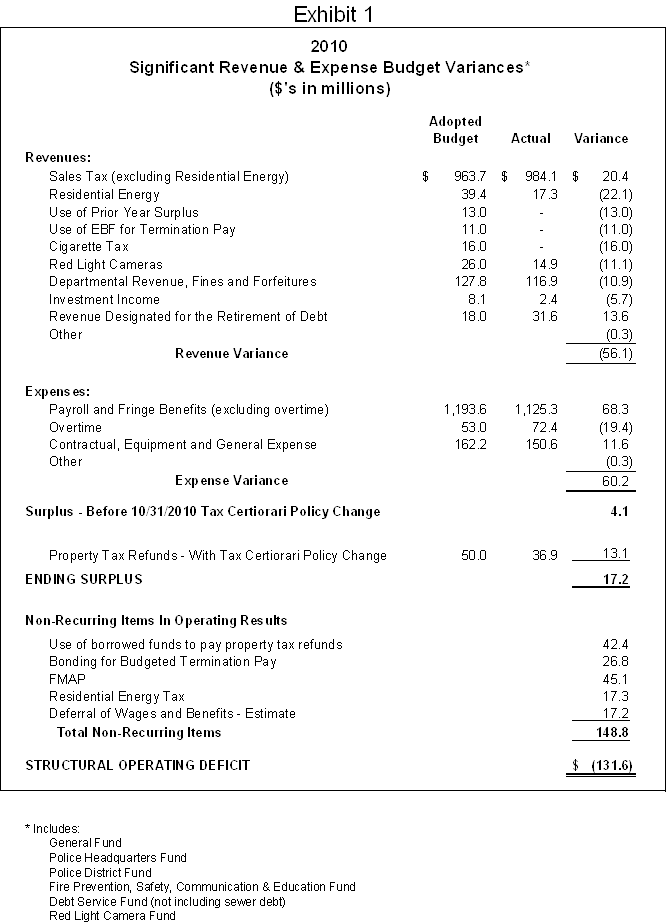

Exhibit 1 (please see attached) summarizes the major budget variances ending in a surplus. The budgeted revenue fell short by $56.1 million, primarily due to optimistic projections by the prior administration which failed to materialize in areas such as the cigarette tax, the budget surplus from the prior year, and the Red Light Camera expansion.

At the same time, expenses during 2010 were lower by $60.2 million than budgeted (excluding real property tax refunds) from two main areas, reduced payroll and fringe benefit costs, and reduced contractual, equipment and general expenses.

The $60.2 million in lower expenses offset the lower revenues of $56.1 million resulting in a $4.1 million surplus for 2010. However, after a policy change in the method of paying for real property tax refunds, effective October 31, 2010, the surplus increased by $13.1 million to $17.2 million. The Administration changed policy to pay future tax certiorari settlements from bond proceeds rather than operating revenues, including the balance of the 2010 payments.

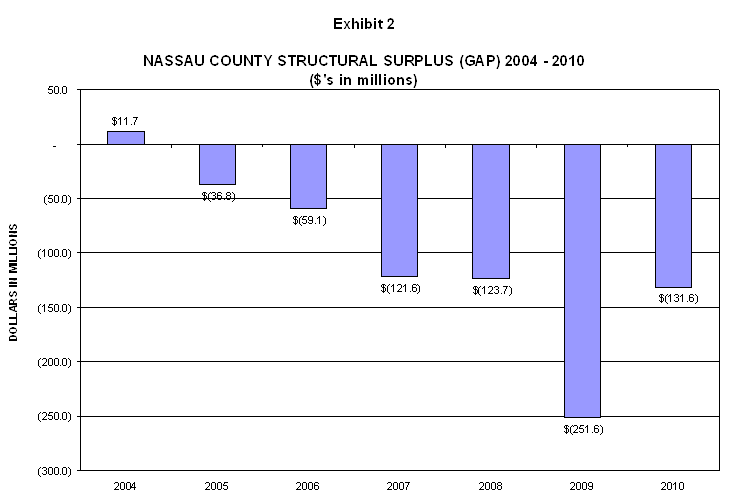

County Executive Mangano was also successful in reducing the structural deficit from $251.6 million in 2009 to $131.6 million in 2010, a 48% improvement over the prior year. This is the first reduction in the structural deficit in the past five years (See Exhibit 2). The structural deficit is the difference between recurring revenues and expenses, excluding “one-shots,” and traditionally has been an important indicator of the County’s long term fiscal health.

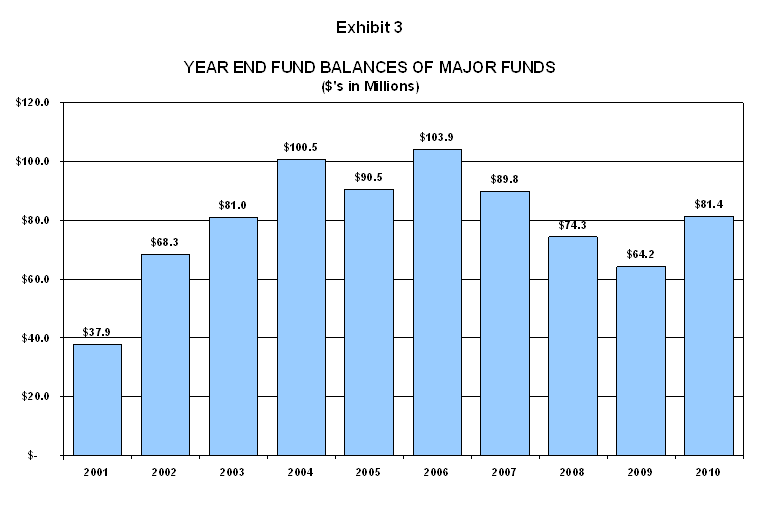

The year-end surplus will help increase the County Fund Balance from $64.2 million to $81.4 million, which is the first increase since 2006 (See Exhibit 3).

County Executive Mangano concluded: “This is all good news for the residents of Nassau County. Taxpayers should rest assure, that I will continue to cut the fat out of government and not seek additional property tax dollars from residents who have been overburdened from years of lavish spending and higher taxes.”

|

|

|