September 7, 2010

Maragos: Nassau County Has Potential to Generate up to $67 million in New Non-Tax Revenues

Nassau County Comptroller George Maragos today released a report that contained a preliminary analysis on various ways to increase non-tax, non-grant revenues. The analysis included a review of Suffolk and Westchester counties budgets, which reported collecting millions more in non-tax revenue than Nassau County.

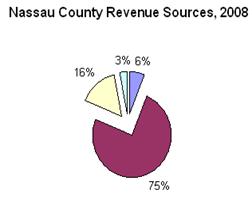

In 2008, Nassau County’s non-tax and non-grant (NTNG) revenue was $174 million, or 6.5% of the total revenue (see fig. 1 below). By contrast comparable counties with smaller budgets such as Suffolk County reported non-tax revenue of 7% or $184.4 million, and Westchester County reported revenue of 11% or $234.7 million.

“Our neighboring counties have been creative and very effective in generating non-tax revenue. If Nassau County can match their performance, the County can increase non-tax revenues by up to $67 million per year and cut into the $286 million deficit projected for 2011,” Comptroller Maragos said. “There is no reason that we cannot be as successful as our neighboring counties in generating comparable non-tax revenue.”

If Nassau County can increase non-tax revenue from 6.5% to 9% of its total revenue, the average of Suffolk and Westchester counties, then the County could generate approximately $67 million in new revenue. The Comptroller’s analysis provides the County Budget Office and the County Executive with a series of NTNG feasible opportunities to attain this goal.

The Comptroller’s review discovered many areas where the County could generate non-tax revenue. Some of the opportunities simply involve the County Departments enforcing rules already in place, while other departments require instituting new programs that have been proven successful in other suburban counties. Implementation of some of these programs may require legislative action.

Below are a few of the opportunities identified for generating non-tax non-grant revenue:

-

Planning Department: Enforce the unauthorized building fine

The Planning Department has the authority to collect a $10,000 fine meant to punish unauthorized building construction. The department has not collected any fines in the last seven years.

- Police Department: Install Muni-meters in County Complex

There is a significant problem with broken parking meters throughout the County. The Nassau County Office of Purchasing and Contracts is looking to run a pilot program of Muni-meters in select parking lots starting in October. Replacing the existing parking meters with Muni-meters will facilitate parking rule enforcement and generate significant revenues.

- Police Department: Improved alarm system fee collection

Owners of alarm systems connected to police response must pay a fee every three years. To ease and ensure collection of this fee, the County should charge the fee to alarm companies instead of hundreds of thousands of alarm owners. The alarm companies would be responsible for collecting the fees from consumers through regular monthly billing.

- Department of Public Works: Restart Adopt-a-Road program

The Department of Public Works had an Adopt-a-Road program which ended in 2007. This program should be renewed.

“These are just a few of the many ideas which if pursued aggressively with a business-like focus, can result in significant new non-tax revenue and reduce the looming 2011 budget deficit,” Comptroller Maragos concluded.

Fig. 1 |

|

For a copy of the full report click below;

![]() Preliminary Analysis of Nassau County's Opportunities to Increase Non-Tax, Non-Grant Revenues

Preliminary Analysis of Nassau County's Opportunities to Increase Non-Tax, Non-Grant Revenues