Mangano Eliminates Property Tax Hikes for the Next Three Years

Release of Multi-Year Plan Reveals County Finances Dramatically Worse than Projected

Nassau County Executive Edward P. Mangano today released an updated Multi-Year Plan (MYP) that eliminates a 13% property tax hike planned by the Suozzi administration for the next three years. The updated plan reveals shocking levels of deficits inherited by the Mangano administration beginning before the end of 2010 and growing disastrously in the next four years.

“When I took office in January, I knew I had inherited a County that had been terribly mismanaged. What I didn’t realize is just how dire the situation is,” said Mangano. “Despite this ugly reality, I refuse to allow property tax hikes at a time when families and seniors are stretched thin. Our county government must learn to do more with less.”

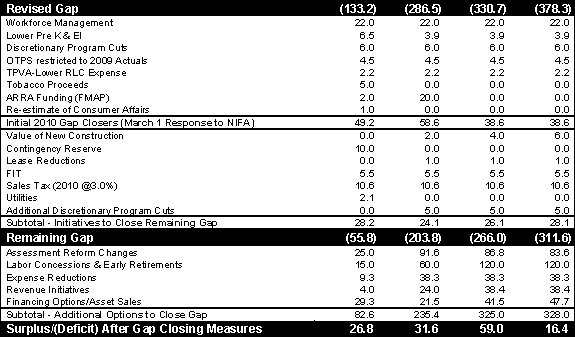

In his review of the previous administration’s 2010-2013 MYP, adopted during October 2009, County Executive Mangano revealed that the finances of the County are dramatically worse than previously projected. The review indicates that the County Executive inherited a budget gap of $133.2 million in 2010, $286.5 million in 2011, and projected to grow to $330.7 million in 2012 and $378.3 million in 2013.

Since Jan. 1, 2010, Mangano has been focused on managing the County to address the 2010 deficit and the deficits which soar beginning in 2011. His first act was to eliminate managerial positions and wasteful spending throughout all layers of our county government. Although it was a step in the right direction, more needs to be done to put our county on the road to recovery.

Nassau County is facing a $286.5 million gap in 2011 – the largest first-year gap ever seen in Nassau County’s history

“This painful deficit was created by the perfect storm of fiscal challenges,” said Mangano. “It is a deadly combination of Nassau’s dysfunctional tax assessment system; long-term, costly and restrictive labor agreements negotiated by the prior Administration; and State and Federal unfunded mandates passed on to the County.”

The Administration recognizes the monumental task that lies ahead in rectifying the current imbalances and providing structurally balanced budgets.

“My top priority is to rebuild our economy by reducing the tax burden on families and seniors, fixing the broken assessment system that results in higher property taxes, and cutting wasteful spending that has contributed to our deficit. We will all share in the sacrifices needed to achieve these results,” said Mangano.

The chart below provides options for dealing with the operating gaps and structural deficit. The gap closing solutions are grouped into five areas: assessment reform changes; labor concessions and early retirements; expense reductions; revenue initiatives; and financing options and asset sales. Over the ensuing four months the County will be working towards implementation of these initiatives and evaluating which are to be included in the budget and MYP proposals due September 15, 2010.

Gap Closing Plan